Black Homeowner’s Appraisal Doubles In Value After White Friend Intervenes

An Indiana woman was stunned to find her property value double after she had a white pal replace her during a home appraisal

It’s expensive to be Black in America. From paying less for housing to earning more in wages, it pays to be white in the USA. And yet a Black woman in Indiana was shocked to see her home appraisal price double after she emptied her home of her racial identity and had a white pal replace her during an appraisal.

Carlette Duffy stated she had two prior appraisals conducted, which saw her property assessed at between $110,000 and $125,000. The home — which is situated in the historic Flanner House Homes area near downtown Indianapolis — was evaluated again, this time with her white friend present.

INDYSTAR-Embed Player

The new appraisal value was $259,000. It’s also worth mentioning that Duffy did no major work to the property in between appraisals. No new outbuildings. No new roof. Just a new face that answered the door for the appraisal.

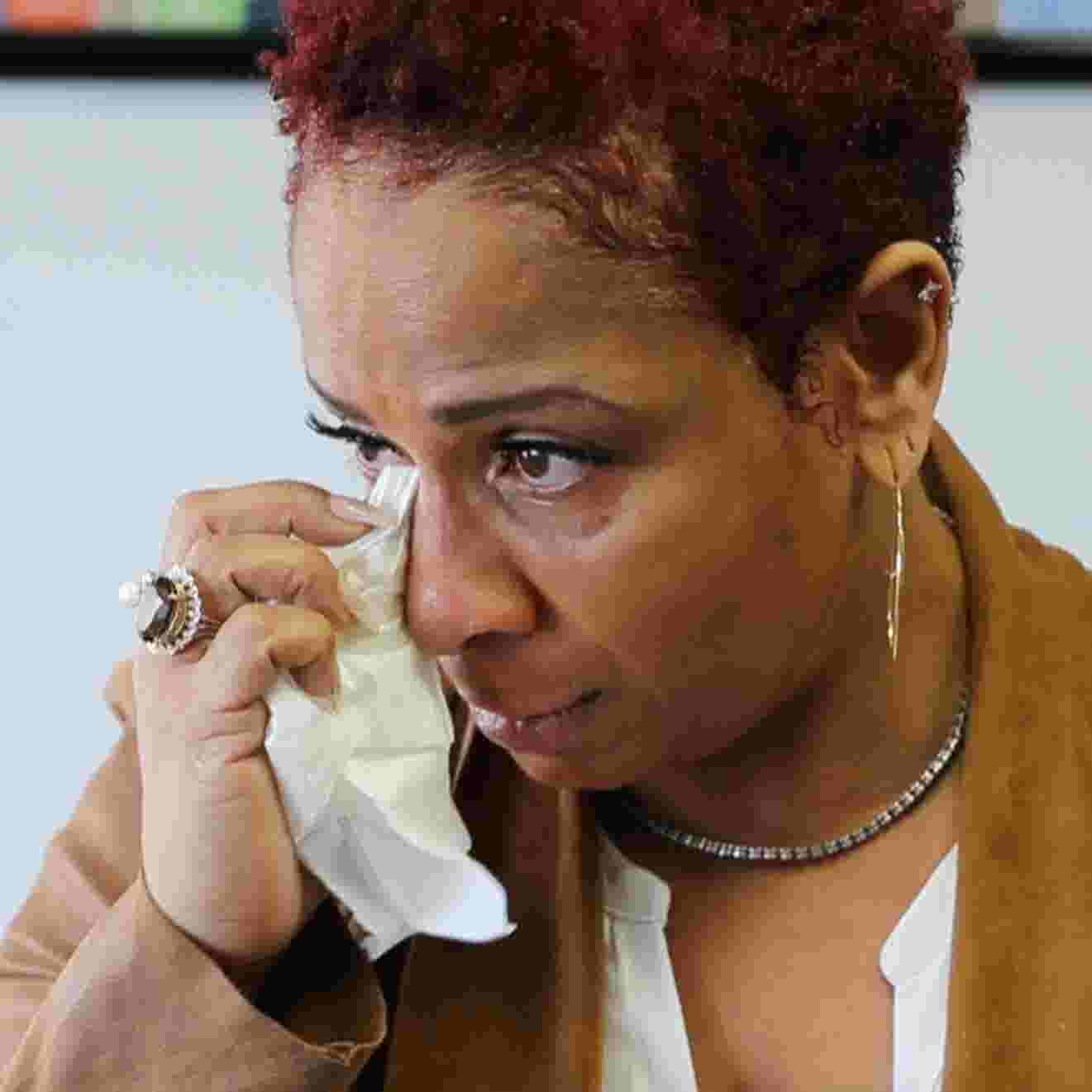

“I was so happy, but then it just sinks in,” Duffy said. “It sinks in, that what was devaluing my home was me.”

Duffy told the Indianapolis Star she felt both relieved and angry. “I had to go through all of that just to say that I was right, and that this is what’s happening,” she told the media outlet. “This is real.”

Duffy has filed fair housing complaints against the mortgage lenders as well as the appraisers who did the initial appraisals. The Fair Housing Center of Central Indiana supports Duffy in her efforts. Damn straight it does. It’s in the name of the center, after all.

The complaint was filed with the U.S. Department of Housing and Urban Development and contends that appraiser Tim Boston, appraiser Jeffrey Pierce, CityWide Home Loans, worker Craig Hodges, lender Freedom Mortgage and two of the company’s employees breached fair housing laws.

The appraisers, Duffy’s complaint said, deliberately pulled comparable sales records that were unfair and racially motivated. She checked the comparable sales in her area and pulled property cards.

Duffy stated she believed the value was wrong, observing that surrounding neighborhoods include the higher priced Ransom Place and Old Northside. “If that’s the case what is the difference in those neighborhoods versus my neighborhood?” she asked.

The complaint alleged CityWide encouraged Duffy to offer figures to challenge the appraised value of her home to decide if omissions had been made. She bought a market analysis for her home which determined a potential list price of $187,000 and provided that to the lender.

Still, the grievance said CityWide informed her no modification would be made based on the documentation she provided.

Duffy wanted to refinance her home and use some of the equity to buy her late grandmother’s home and restore it. She confessed she noticed “red flags” during the appraisal process and questioned Boston with additional documentation. He rejects that claim.

According to Duffy, friends and family urged her to consider if discrimination played a part in the appraisals.

“I staged my home to look as ethnically neutral as possible,” she said. “I was just numb to it, and I think it was more so numb just because it was me just going through the process, like I’m not crazy. I’m not crazy. I’m not crazy.”

Duffy certainly isn’t crazy. The gaslighting of discriminatory practices is been something the Black community will no longer stand for. In February of this year, a Black couple in Marin City, California went viral after sharing the story that their home was undervalued by more than $500,000 when they gained a second appraisal. They had white friends pose as the owners of their home as well.