This Chart Explains What Your Family Will Get From The Stimulus Package

With plans for stimulus checks as well as an expansion of the child tax credit into monthly payments, American households should have a little more wiggle room

COVID-19 has taken more than thousands of lives. The virus has exposed what many already knew: that many Americans are only a paycheck or two away from financial disaster. The economic repercussions of the pandemic have devastated many families: from teachers who have no choice but to return to the classroom to retail workers who find themselves out of work due to closed storefronts, most families are feeling the pinch.

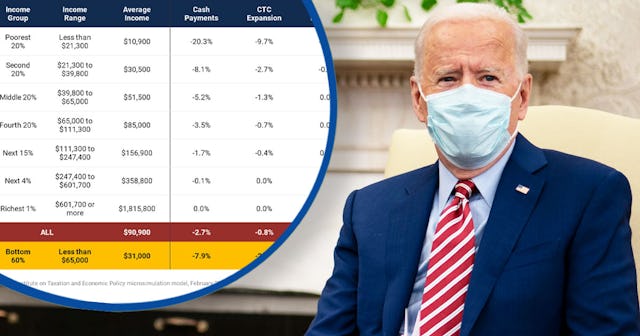

President Biden’s $1.9 trillion stimulus package, called the American Rescue Plan, has been somewhat of a mystery to the average taxpayer. Luckily the Institute On Taxation And Public Policy (ITEP) has done a deep dive on the numbers to figure out how much American families will receive.

Institute on Taxation and Economic Policy microsimulation model, February 2021

Institute on Taxation and Economic Policy microsimulation model, February 2021

With payments of $1,400, plus the expansion of the earned income tax credits, and child tax credits, this means a large portion of the stimulus package will be as cash payments that are meant to be distributed to low- and middle-income Americans.

As the first rounds of economic stimulus seemed to be more targeted to businesses, the new package is a marked shift from the previous administration’s plan. While pundits have spoken about the financial relief coming to families, it’s been an open question about what it means for individual households.

ITEP took a look at the figures and determined what kind of an influence the package could make on different income brackets on average if, and when, it turns into law. It’s important to remember that the numbers are an average – some families will get more, some families, less.

For households which make less than $21,300 per year as a family (or about $10,900 per partner), they would receive an average of $2,210 in a cash payment, $1,060 in the child tax credit, plus $320 in the earned income tax credit.

Families whose average income is $30,500, would get $2,460 in cash payments, $820 in child tax credits, and $60 in earned income tax credit. Households bringing in $51,500 would get $2,690 in cash payments, $660 in child tax credits and $20 in earned income tax credit.

As the household income level rises, the stimulus funds drop significantly. Households earning $85,000 a year should see a cash payment of $3,000, child tax credits of $620 and $10 earned income tax credits. The highest tier at $1.8 million in annual income, are on track to receive $40 in cash payments, $10 in child tax credits, and zero for earned income tax credits.

It’s important to repeat that these numbers are averages. Some families will get the child tax credit, while other households who have children over 18 won’t benefit from certain parts of the plan. The number of dependents is also a factor – some families will receive much more than the estimated payments, while some while receive less.

The chart is meant to be used as a general guideline for how the Biden administration plans to allocate the funds to the American public.

For more information, head to ITEP to see each chart (and see how the organization came up with the numbers).

This article was originally published on