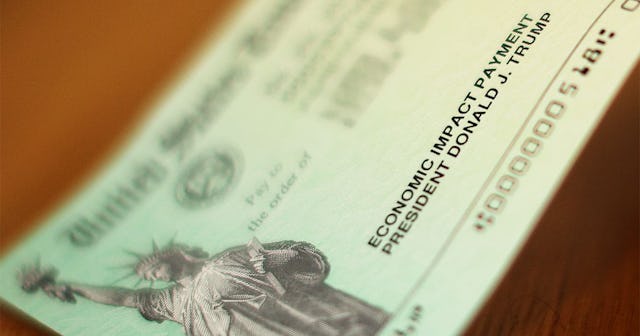

The IRS Sent Out $1.4 Billion In Stimulus Checks To Dead People

According to a new report, the IRS and Treasury Department handed out over 1 million stimulus checks to people who are deceased

In an effort to stimulate the economy and help American citizens get back on their feet during the COVID-19 pandemic, the United States government issued stimulus checks to those who qualified financially. In fact, according to the IRS, 159 million checks totaling $267 billion were distributed under the law. The only issue? In addition to many Americans not getting the funds needed to ride the wave of the financial meltdown, 1 million of those payments — totaling a whopping 1.4 billion dollars — were issued to dead people, according to a watchdog agency.

In a new report, the Government Accountability Office explains that when Congress passed their $2 trillion stimulus package, the CARES Act, legal misinterpretation led to the Treasury Department and the Internal Revenue Service unable to use government death records “which did not include using [Social Security Administration] death records as a filter to halt payments to decedents” to ensure that dead people would not receive the checks.

“The Internal Revenue Service (IRS) and the Treasury moved quickly to disburse 160.4 million payments worth $269 billion. The agencies faced difficulties delivering payments to some individuals, and faced additional risks related to making improper payments to ineligible individuals, such as decedents, and fraud. For example, according to the Treasury Inspector General for Tax Administration, as of April 30, almost 1.1 million payments totaling nearly $1.4 billion had gone to decedents,” reads the report.

The checks, referred to as Economic Impact Payments, were issued to eligible Americans based on their 2018 or 2019 income tax returns. Individuals making up to $75,000 a year received checks for $1,200 and couples making up to $150,000 and filing a joint tax return received $2,400, with an additional $500 per qualifying child. The payments decreased accordingly for people making more than $75,000, with an income cap of $99,000 per individual or $198,000 for couples.

Reports of dead people receiving stimulus payments first started surfacing in April, when the IRS began making direct deposits of up to $1,200 into taxpayers’ bank accounts. In May, the Treasury Department revealed that some stimulus checks had been sent to dead people, ordering those who received a check on behalf of a deceased relative to return the money immediately. However, minus the announcement on the IRS website, the governmental agency has not and does not plan on taking additional steps to have the money returned, according to the GAO.

The GAO recommends that IRS should “consider cost-effective options” for notifying ineligible recipients how to return payments. And, according to the report, the IRS agreed with the recommendation.