My Husband And I Are Living With 'Sexually Transmitted Debt'

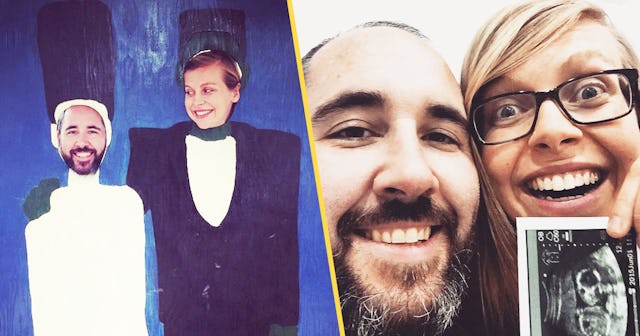

When my husband, Matt, and I got together, we had a lot of initial talks to help hash out the important issues. While he hadn’t considered having more kids beyond the child from his first marriage, he knew how much I wanted kids and was totally open to making a family with me. I knew how much Matt loved his daughter and was excited when we figured out how we’d include her in our new life together.

When the topic of money came up, we both enthusiastically jumped at the future idea of a joint bank account. I couldn’t believe that I’d met someone as inclusive and supportive about money as me. And yet there was Matt, ready to pool our money together for the good of the team. Since neither of us had felt like our past relationships embodied true financial partnership, this agreement felt comforting and gave us both a lot of hope.

But there was one pesky detail that didn’t make it into any part of our conversations. Matt and I were both carrying around a bunch of consumer and student loan debt from painful and distressing times in our lives. By the time we both felt comfortable enough to reveal our flawed financial pasts with each other, I was already pregnant with our firstborn. In true teammate fashion, we decided to face our debt together, agreeing to share in the responsibility of handling it.

I didn’t even know that our delicate situation had a nickname, but now I humbly do. Apparently, Matt and I are victims of each other’s “sexually transmitted debt.” His low credit score has kept us from ever easily securing an affordable car loan, and my score makes renting an apartment embarrassingly challenging. Essentially, we unwittingly contracted debt from each other and would have to live with our financial dis-ease until we can recover from it.

I thought Matt and I were alone in our struggles, until I came across a buzzworthy survey conducted by the folks at Finder.com. According to their findings, 1 in 6 Americans have “sexually transmitted debt,” which is usually contracted from an ex or current romantic partner. The top reasons are as varied as they are relatable and include marriage, purchases made in the partner’s name (or through a joint bank account), a divorce settlement, or the death of a loved one. The most popular types of inherited debt range from credit cards to auto or student loans, with medical bills and personal loans also rounding out the list.

“For people who took on a partner’s debt, the numbers shake out to an average of $23,238 in debt contracted as a result of a romantic relationship,” the article in which the survey is shared explains. “Staying with our subtle (wink!) analogy, sexually transmitted infections account for roughly $16 billion in health care costs annually, whereas American adults share a ludicrous $921 billion in accrued debt from those who don’t practice safe spending.”

I completely understand why the surveyors label debt-heavy spending as unsafe, but it’s an unbearably tough pill to swallow as someone who never consciously intended to be in the financial spot I’m in today. I also have so much compassion for those who endure undeserved financial abuse that can include the trauma of having their credit unknowingly destroyed by a reckless spouse. But what about the couples who are sincerely trying to do their best with each other, have moved through adversity in the only way they could, and still get that scarlet “D” placed on their chests?

It’s easy to look at the numbers and assume the worst about those who have initially concealed their debt from a partner. But if you take a closer look, you’d see that there’s much more to the story.

My husband comes from a family with modest beginnings, and he’s also been through a lot in his life. When he finally decided to go to college at 26, Matt already had a baby girl on the way and a new marriage facing its fair share of hardships. With no extra money in the bank, my husband resorted to taking out hefty student loans to pay for animation school. Little did he realize, the college he was being loaned money to attend was actually a for-profit school that would ultimately be sued for fraud by the government.

All my husband wanted was to find his career path, provide for his growing family, and do something with his life that he’d feel proud of. Like so many of us, Matt didn’t think through the long-term burden that paying off an exorbitant student loan would be. And more importantly, he didn’t have much of a choice when it came to paying for college, since he grew up without the means to feasibly do it.

After a heartbreaking separation from my first husband, I found myself living alone in a studio and struggling to make ends meet on my own. I had feared credit cards my entire adult life because I saw how much they destroyed my mom’s livelihood growing up. I remember her battling constantly with debt collectors, and I never wanted to be in that place myself. I spent years avoiding credit cards like the plague and was just shy of thirty when I decided to even consider getting one.

Barely able to keep myself afloat, I eventually succumbed to the pressure and took out several lines of credit. I was completely in the dark about how the whole process worked, and I didn’t earn enough money to handle the interest-heavy payments. When I tearfully shared with Matt how much debt I had accumulated, he showed a surprising amount of compassion that I’ll never forget.

Since I already had a sizable balance of student loan debt left over from my college years, I empathized with Matt when he confessed to me the financial secret he felt so much shame about. Much like my husband, I was a naïve young adult who had absolutely no clue what I was getting into when I agreed to borrow money for school. No one had explained to me the sobering repercussions of those actions to the point of me fully understanding them, and it seemed Matt had been in a similar boat.

Our “sexually transmitted debt” still looms over us to this day, and it’s the cause of a ton of stress and anxiety for us both. Thankfully, we still manage to keep a team-oriented mind when talking about seeking financial relief, and this helps when the problem feels more overwhelming than both of us can handle.

I want to focus for a minute on the term that’s being used here to describe inherited debt, unexpected or otherwise, in a relationship. A huge part of the reason people keep the truth about an actual STD hidden from others is the societal stigma we have around them in the first place. Sexually transmitted diseases are a cause of shame for so many people who live with them, largely because we’ve been taught as a culture to be wary of anyone who has one. Much like sex, finances are often placed at the bottom of the “big talk list” our educators and parents usually aim to have with us. Both are extremely complicated areas of life, yet they’re also essential to our survival in many ways.

It’s important to create open lines of communication around finances (and sex!) prior to the commitment of a relationship, and we need to create more compassionate and supportive ways of looking at our staggering debt crisis. We are a country filled with many who struggle to meet the basic needs of living, and yet we are constantly bombarded with reasons to be active consumers. Financial education should be the cornerstone of what we learn growing up, and we need to be provided with affordable and accessible resources to help us prepare for adulthood.

I firmly believe that if I had been properly educated about money and shown a positive example from my caregivers of how to handle finances, I wouldn’t be where I am today. But to look at the situation with this narrow of a lens ignores the financial adversity that both of my parents survived in their childhoods. It’s time to break the destructive cycle that promotes secrecy and shame around how we spend our money. And that starts with my husband and I modeling for our children empathy, openness, and trust as we learn how to consciously manage our finances for the first time.

This article was originally published on